B2B buying is about a complex set of touch-points between the buyer and brand over multiple channels and multiple months/years.

The prevalent model is to a) have data that shows where any buyer is in their journey b) have a way to reach buyers, depending on their stage, in the right channel (SDR, paid ads etc) at the right time c) reach the buyer when they are ready to buy, and hopefully by that time they are already warmed up to your brand.

How do we use data to drive B2B sales and marketing?

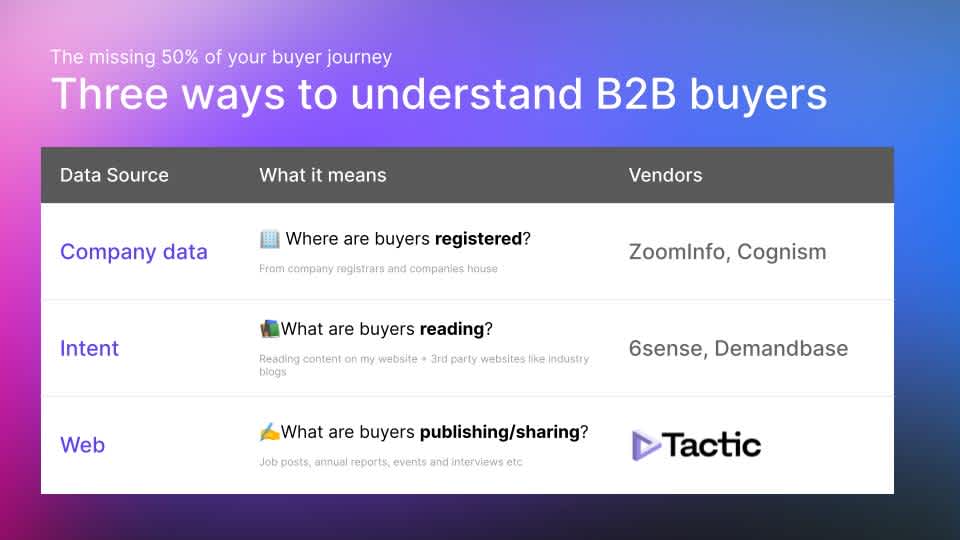

If we zoom in on how we use data to “peek into what the buyer is doing”, there are broadly three categories – basic “business directory” firmographics, buyer intent across 1st party and 3rd party websites, and web data. These roughly answer “do they exist?”, “what are buyers reading?” and “what are buyers publishing?”

Web data is a rich source of information that’s commonly thought of as individual categories: annual reports, financial filings (10-K, 10-Q etc) job postings, news, company website keywords and more. A somewhat mis-fit category is people data, like when do execs switch jobs.

In the 2022 tech landscape, GTM teams typically have a mature solution in place for company data (usually ZoomInfo) and buyer intent (6sense, DemandBase, G2, pick one or more).

What they then still find is a mix of the following issues – not enough pipeline, running out of marketing spend, and high outbound activity but low conversion rates.

In the 2022 tech landscape, GTM teams typically have a mature solution in place for company data (usually ZoomInfo) and buyer intent (6sense, DemandBase, G2, pick one or more). What they then still find is a mix of the following issues – not enough pipeline, running out of marketing spend, and high outbound activity but low conversion rates.

How can we deliver the right data at the right time to sales and marketing teams?

Forward thinking GTM leaders have identified that this is because their current data doesn’t fully show the context of the customer, and therefore the messaging is not resonating. To solve this problem, they invest in three types of solutions:

Pushing their people to do more research – Mandating account plans, Top 10 accounts, value pyramids, filling in ‘triggers’ in the CRM etc all help with this. The issue is that this is manual and inefficient, the reps hate it, and it’s difficult to scale.

Building an in house team to do research – These are typically called ADRs (account development reps), lead generation specialists or customer intelligence teams and are managed by RevOps. The problem here is that the folks who work on your data (ADRs) are separate from the folks who use the data (sales reps). Data produced by a different team often lack the context that sales reps want, and doesn’t fully support commercial decisions. Your ROI on investing in a big team of people then suffers.

Building an in house “360 customer view” tool – A technical team is hired, integrations are built, and data vendors are evaluated. This is a big investment, and requires a company to invest in capabilities beyond their core offering: natural language processing, big data, and UX. Adoption is a challenge as you need training for the internal tool.

It’s so complicated.

How is Tactic different from company and intent data?

Related: Why customers choose Tactic vs. 6sense

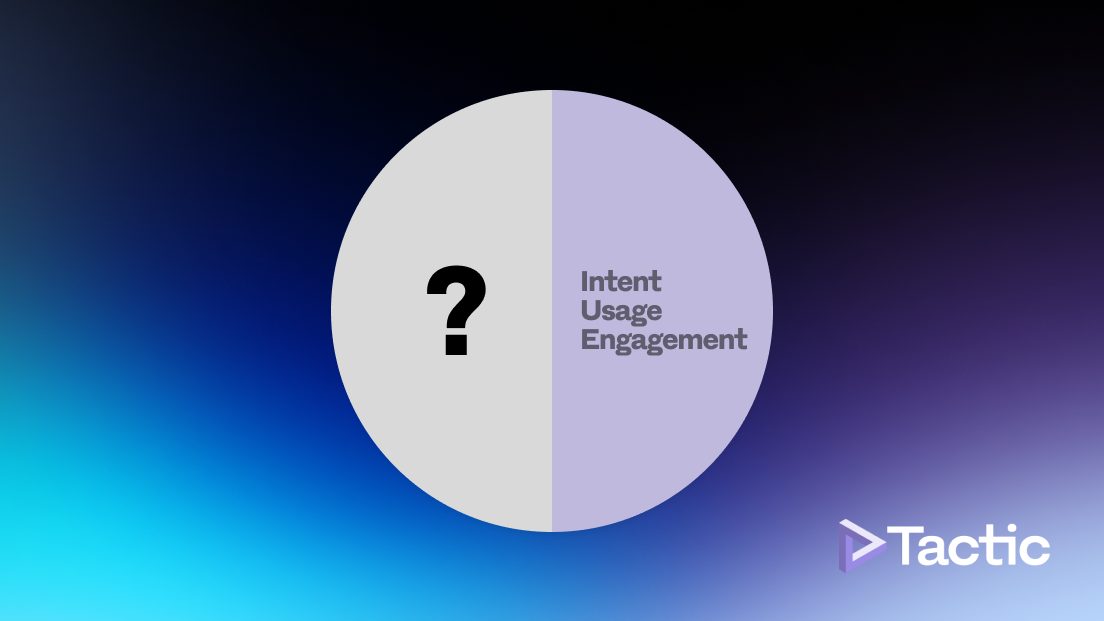

In the end, you have half a solution, and you are still missing 50% of the picture: what is the buyer publishing and sharing?

This is why we’ve built Tactic.

As salespeople, we already know how critical it is to do our research. We know that we need to find the highest fit of prospects, understand whether there are any timing signals, and craft messaging that resonates. Everybody says it's about doing your research. Whatever account list you throw our way, we will Google through it anyway.

Because of that, we’ve designed a solution that enables you to capture the missing 50% of the buyer journey using web data.

We are indexing the entire internet for you, so you don’t need to worry about your AWS bill or how to work with petabytes of data.

You can specify what data and insights you need to understand your buyers at scale, using a self serve interface. Natural language technology means that you can get answers without writing code.

We’ve designed a beautiful UI with a seamless integration with your Salesforce, and a world class training and enablement program, so you don’t need to worry about adoption and ROI of your new data.

Crucially, we have built tools for your sales and marketing teams to provide feedback on the data, plus custom programs like closed won analysis. This means that you can iterate on your insights and build a feedback loop on your CRM data.

And that’s why, even when you have ZoomInfo and 6sense, you are still missing 50% of your buyer’s journey. And Tactic is your answer.